Ignoring invoice reconciliation is buying a direct ticket to closing your business. Read this blog post to learn to reconcile invoices using simple steps.

How To Reconcile Invoices in 3 Simple Steps

Reconciling invoices is one of the most critical tasks that any business, small or large, must carry out. Although many consider it one of the tasks on the to-do list, it has many benefits that make it a necessary and must-do process for small and large businesses.

Before we continue, everyone must understand what invoice reconciliation is, and the benefits and steps followed to reconcile invoices. Let’s get started!

What is Invoice Reconciliation?

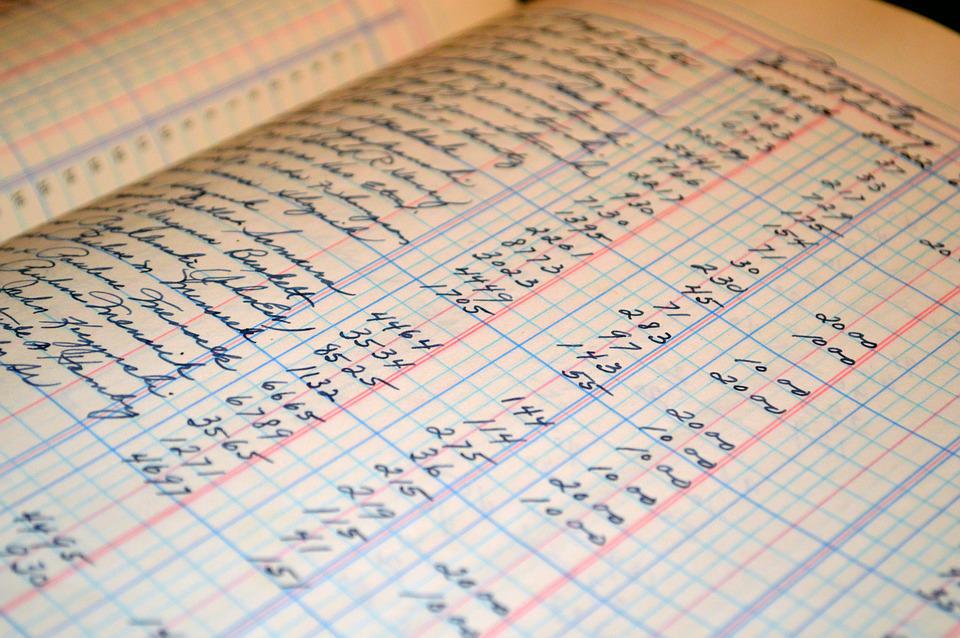

Reconciliation of invoices ensures that internally recorded transactions match monthly statements from external sources like banks. Through the process of reconciliation, businesses can determine if there are any differences in the records and correct them before it is too late.

Noticing differences during reconciliation is normal, and many reasons contribute to that. Some of the causes of the differencesduring business reconciliation include the following:

- Your reconciliation period is different from the time of payments.

- Some invoices may be duplicated or omitted.

- When delivery of goods is delayed leading to payment delays.

- Discounts have been issued for early payment

- An invoice is paid partially.

When you notice any anomaly during invoice matching, it is good to determine the cause of the anomaly. If it is any of the reasons mentioned above, you can correct it or otherwise detect a fraud that led to losses and even the closure of businesses.

Why Businesses Must Reconcile Invoices

Reconciling invoices is never easy, but the potential impact it always has on the income of businesses makes it a worthy process to undertake. Businesses are encouraged to performreconciliation regularly and update the payment status.

There are many reasons for conducting reconciliation, but the main ones are two, and they include the following:

- Detect Fraudulent Activities

Employees stealing from their companies is a common phenomenon that several companies have experienced. According to statistics, businesses in the United States have been highlighted to lose about $50 billion annually. Fraud is causing many firms to crumble to their knees.

Thus, any business must always be on the lookout to detect fraudulent activities within the industry before it goes bankrupt. Many companies are implementing systems that can detect fraud and reduce the much paperwork done.

Whatever type of reconciliation you are using, you will be able to detect fraud when you ensure the process is done regularly and by different employees. When an employee is fixed to do the job, he may find loopholes and try to steal from the business.

- Improve Customer Experience

No customer would be pleased to be sent an invoice full of errors. Reconciling invoices may be thought of as a process later in the back office, but it influences your customers’ experiences. Through reconciling invoices, anomalies, can be solved and prevent delays in payment or sending customers invoices with errors.

Steps of How to Reconcile Invoices

There are two types of invoices to consider when you reconcile invoices. These invoices are the vendor and the customer invoices. The mentioned invoices always require slightly different steps when reconciling them.

Moreover, when dealing with vendor invoices, the steps may differ depending on whether it is a product or service you purchased. This section will outline the various steps businesses must follow when reconciling vendor and customer invoices.

How to Reconcile Vendor Invoices

When a business purchases a new product, the steps discussed here are the ones used to reconcile invoices.

Step 1. Confirm you have received all the items upon arrival of the order.

Reconciling invoices begins immediately after your order has arrived at your premises. In this step, the business must ensure all the received items match the ordered ones. To achieve the reconciliation process, firstly, you must go line by line and compare the packing list with what was shipped, and secondly, you must compare all the shippeditems with your purchase order.

Step 2. The final step in reconciling vendor invoices is receiving your order’s invoice.

Once a business is handed the invoice for their order, the next step is to match the purchase order to the invoice. You are supposed to approve the invoice upon confirming everything matches and enter the invoice number to the accounting department for payment processing. Otherwise, inform your vendor of any discrepancies as soon as possible to get an updated invoice.

When a business purchases a service, physical goods will not be delivered. In such a case, a company can reconcile the invoice by comparing the vendor invoice with your contract. By comparing the invoice and the contract, you can ascertain whether the figures match or if an error exists.

How to Reconcile Customer Invoices

Step 1. Check invoice for Consistency before sending to customers

It is always a good gesture to ensure all the invoices sent to your customers have no errors. So, after creating the invoice, match it with the purchase order or contract and send it after ensuring the payment policies, dates, and other vital details are correct.

No customer will be happy to see errors in their invoices, which will lead to trust issues with your clients, which may not be suitable for your business.

Step 2. Match the received payment for the invoice

Once your customers have made the payment, confirm if their payment matches the invoice. Let your customers know if you notice any error, even if it favors your business.

Step 3. Reconcile invoices and bank statements monthly

Every month, ensure your business receives a bank statement for double-checking purposes and confirming thatthe invoices match the deposits made.

With the simple steps explained above, reconciling invoices will no longer be an issue. Additionally, businesses need to equip themselves with the knowledge of streamlining the reconciliation process. If you wish to learn more about streamlining the reconciliation process, continue reading.

How You Can Streamline the Invoice Reconciliation Process

- Acquire an Effective Accounting Software

Many accounting tools have been developed, makingreconciliation easier and cheaper. The extent of reconciliation automation will primarily depend on the software tool that your business will select.

Any business operating without a software tool is encouraged to acquire one because it is affordable and can get business software for $ 15 per month. The fee is reasonable compared to the errors you will reduce and the time saved instead of manual reconciliation.

- Develop Your Desired Process to Reconcile Invoices

The post outlined the simple steps you can follow to reconcile invoices, but you must develop your desired process that will favor your business. Besides, it is recommendable to turn your process into a checklist and outline key areas that most affect your business.

Some of the areas you can include in your checklist can consist of the following:

- Were customer payments charged transfer or currency fees?

- Did any invoices of your customers get a discount?

- Is there any amount rolling from a previous balance?

Frequently Asked Questions (FAQ)

- How can I create an invoice?

Creating an invoice has been made easier and quicker with the help of online software. If you are new to creating invoices, search for some of the trusted online services you can use.

- Is it mustI use software for the reconciliation of invoices?

The choice to use software for reconciliation depends on you. However, it is essential to note that businesses that use software save a lot of time and makes the billings process easier. Most software has important features that automate the process and provide valuable insights for your business. To enjoy such benefits and many more, you must use software to do reconciliation.

- Can I create an invoice using Microsoft Word?

Yes. You can create an invoice by selecting the suitable templates listed online. Download a template, then fill in the necessary details you want in the sections.

Conclusion

Many factors determine how to reconcile invoices in your business. Such factors include your suppliers, the selected accounting software, the size of your team, and other factors. So, there are many approaches you can take to reconcile invoices for your company.

Any business that wishes to succeed in the competitive market ought to find a suitable process it would adopt to conduct reconciliation. Therefore, a business needs to develop its steps and test them. Once a company finds the strategythat works for them,it can adjust it as needed to suit its needs.

Moreover, businesses should use software rather than going for the manual way of reconciling invoices. If you wish to save time and speed up the billing process of invoices for your customers, ensure you use software to reconcile invoices.