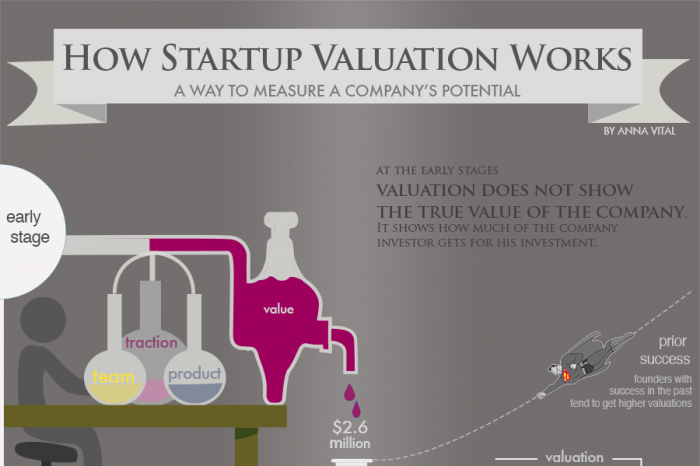

When starting a business, one of your most important decisions is how to value your company. This choice will significantly influence how much money investors are willing to provide, which isn’t always simple. In this guide, we’ll walk you through the process of startup valuation and show you how to come up with a number that makes sense for your business.

Investment companies, banks, and startup accelerator programs often ask for a business’s valuation before investing. A startup’s valuation is also an essential metric for entrepreneurs to track internally.

Business investors, such as venture capitalists, use several methods to value startups before making investments in startups.

Knowing how to utilize startup valuation formulas is essential for novices, expert entrepreneurs, and investment companies. You can only go so far with little money. Your startup concept may fall apart if you don’t allow it to take off and find an investor for business. To avoid this, make sure you understand various ways of valuing startups. Here are some we recommend you try:

How do investors for a startup do Startup Valuation?

Cost-to-Duplicate Method

This method incorporates the startup’s and product’s expenses and expenditures. This approach can be helpful when looking for investors at the pre-revenue stage because most skilled investors may not invest much more than the market value of the assets.

However, there are a few drawbacks. It does not affect the company’s future potential, nor does it include intangibles such as ideas, brand recognition, and goodwill (in addition to tangible assets). Even earlier, these intangible assets may provide more value regarding startup valuation.

Berkus Method

It aims to quantify the progress of every company for it to begin operating. If you want to find investors online or offline, you should use the Berkus Method.

In a nutshell, it assesses value based on the five factors:

- Business Idea

- Prototype

- Management Team

- Traction/Market Validation

- Intellectual Property (IP) or Other Secret Sauce.

The Venture Capital Method is a more sophisticated way of startup valuation that Venture Capital firms India commonly use. arrive at this number, VCs use several factors, including the stage of the company, the size of the market opportunity, and the quality of the management team. The Venture Capital Method can be a valuable tool for entrepreneurs looking to raise capital from VC firms.

The Scorecard Valuation Method

The Scorecard Valuation Method is based on a set of criteria that startups can use to evaluate their progress and value.

The criteria include:

– The stage of the company

– The size of the market opportunity

– The quality of the team

– The quality of the product

– The traction/momentum of the company.

Based on these factors, startups can give themselves a score and arrive at a valuation. This method is helpful for entrepreneurs who want to get a sense of their progress and value.

The cost to duplicate a business is expensive, but it can be worth it to find out how much it would cost to start over. You need to research this carefully.

Discounted Cash Flow Model

How do you find Investors Online for Startups?

The cost to duplicate approach is a realistic plan that challenges a startup’s competitive advantages. If duplicating the business model is very inexpensive, the company’s value will be close to nil.

There are several ways to find investor for business. One option is to search for investment companies that specialize in funding startups. These companies typically have websites where you can submit information about your business and request financing. Several websites allow you to search for potential investors based on their location and area of interest.

Conclusion

The most important thing is to choose the right method for your business and use it as a guide to help you assess your progress and value. Remember, there is no one-size-fits-all approach to startup valuation, so it’s essential to tailor your method to your specific needs. By using the proper valuation method, you’ll better understand your business and make more informed decisions about how to grow it.